Ny Income Tax Brackets 2025 Single. Remember that this tax is in. There are currently nine tax brackets in.

Head of household nyc tax. View all tax calculators and tools in the new york tax hub or use the new york tax calculator for 2025 (2025 tax return).

Married Filing Jointly Nyc Tax Brackets;

The ranges cover two types of filers:

This Page Has The Latest New York Brackets And Tax Rates, Plus A New York Income Tax Calculator.

4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

Residency Status Also Determines What’s.

Images References :

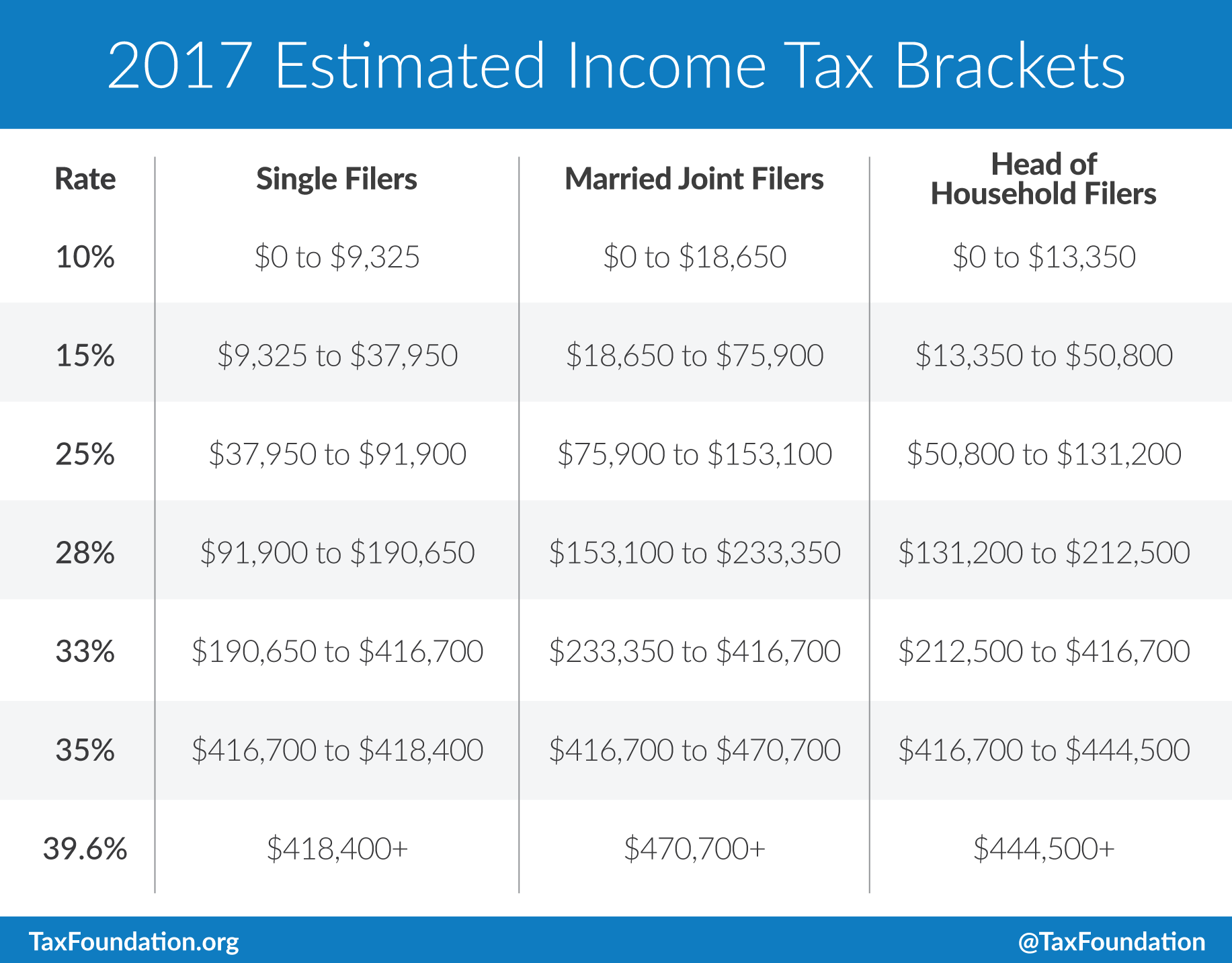

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2025 Tax Brackets What You Need To Know, New york's 2025 income tax ranges from 4% to 10.9%. Efiling is easier, faster, and safer than filling out paper tax forms.

Here are the federal tax brackets for 2025 vs. 2022 Narrative News, File your new york and federal tax returns online with turbotax in minutes. This page has the latest new york brackets and tax rates, plus a new york income tax calculator.

What tax bracket am I in? Here's how to find out Business Insider Africa, Free for simple returns, with. Single or married filing separately nyc tax brackets;

Source: vptiklo.weebly.com

Source: vptiklo.weebly.com

Tax brackets 2019 vptiklo, The state applies taxes progressively (as does the federal government ), with higher earners paying higher rates. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

110,000 a Year Is How Much an Hour? Top Dollar, 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.aiophotoz.com

Source: www.aiophotoz.com

State Individual Tax Rates And Brackets 2017 Tax Foundation, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. New york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

Here's how to find how what tax bracket you're in for 2020 Business, Head of household nyc tax. New york city income tax rates vary from 3.078% to 3.876% of individuals’ new york adjusted gross income, depending on your tax bracket and what status you are filing.

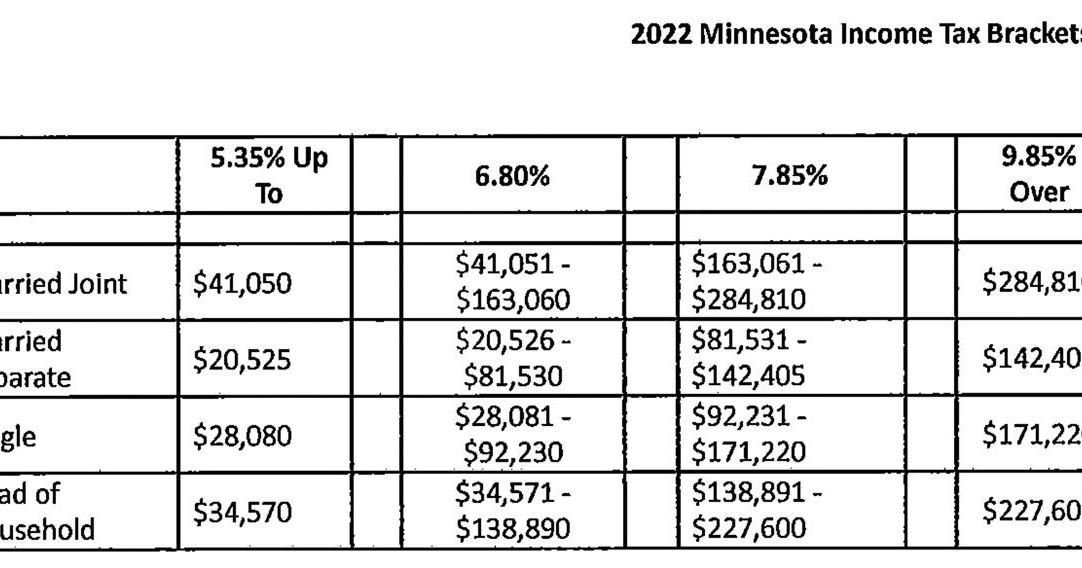

Source: www.walkermn.com

Source: www.walkermn.com

Minnesota tax brackets, standard deduction and dependent, Estimate your tax liability based on your income, location and other conditions. New york city income tax rates vary from 3.078% to 3.876% of individuals’ new york adjusted gross income, depending on your tax bracket and what status you are filing.

Source: neswblogs.com

Source: neswblogs.com

Tax Filing 2022 Usa Latest News Update, 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. However, that taxpayer would not pay that rate on all $50,000.

Source: politicalbullpen.com

Source: politicalbullpen.com

IRS Here are the new tax brackets for 2025 Economics, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Married filing jointly nyc tax brackets;

New York Tax Calculator 2025.

For your 2025 taxes (which you'll file in early 2025), only individuals making more than.

This Page Has The Latest New York Brackets And Tax Rates, Plus A New York Income Tax Calculator.

New york state has a progressive income tax system, which means that the more income you earn, the higher your tax rate.