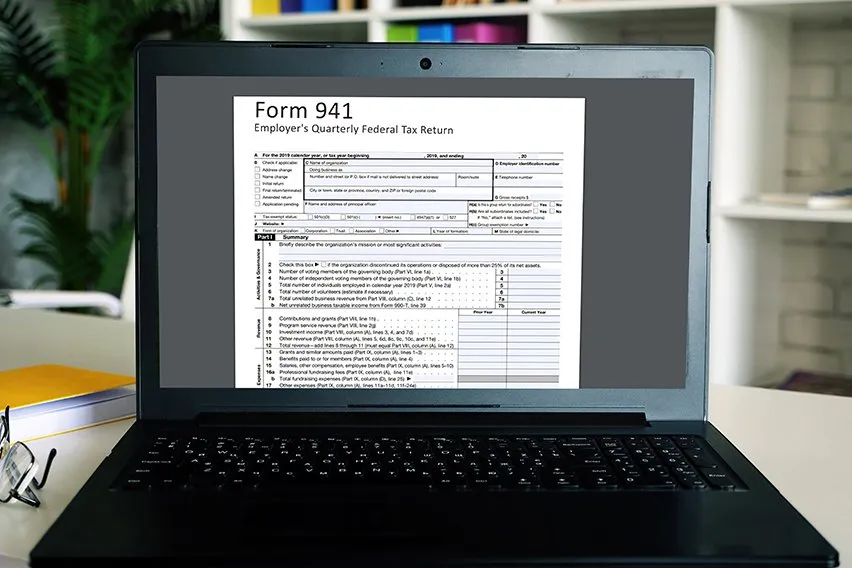

2024 941 Quarterly Employer Form. Insights into the form 941 for 2023 & 2024 tax years data required on form 941. That said, you'll need to wait for the latest updates from quickbooks for the latest and most accurate data for tax form filings.

Tax year 2023 guide to the employer’s quarterly federal tax form 941. Comment on tax forms and publications.

Schedule R, Allocation Schedule For Aggregate Form 941 Filers;

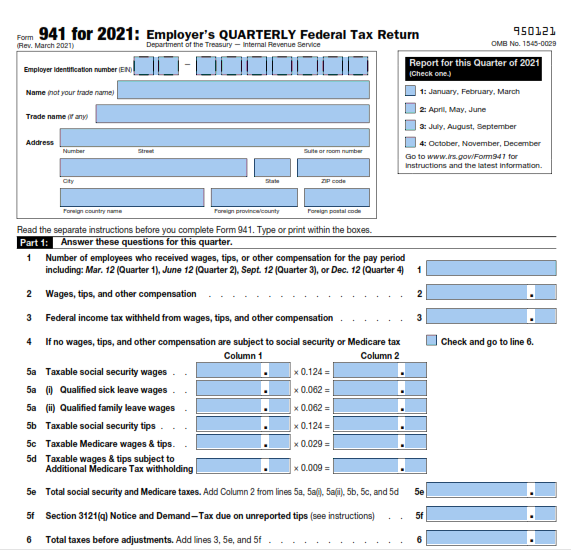

The final release included form 941, employer’s quarterly federal tax return;

In 2024, Employers Will Utilize Form 941 For The Tax Year 2023 To Report Income Taxes, Social Security Tax, And Medicare Tax Withheld From Employees' Wages, Along With Employer Contributions For Social Security And Medicare.

The calculation of these taxes while filing your return can be quite confusing.

2024 941 Quarterly Employer Form Images References :

Source: www.printableform.net

Source: www.printableform.net

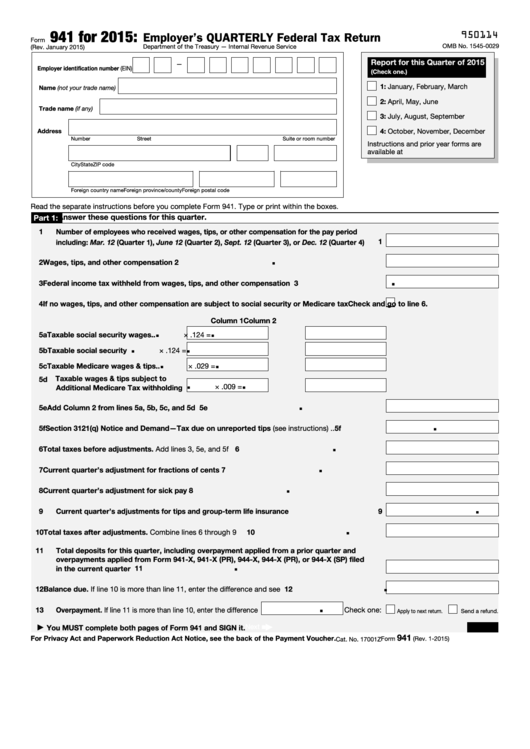

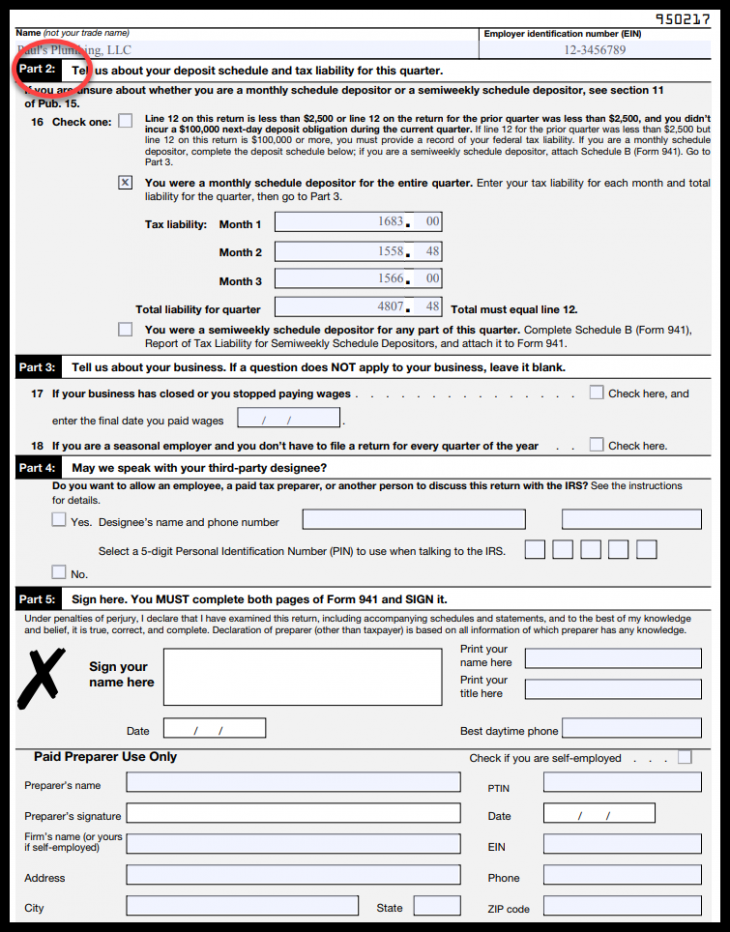

Printable 941 Quarterly Form Printable Form 2024, Schedule b, report of tax liability for semiweekly schedule depositors; Employ a household employee (e.g., nanny) have farm employees (e.g., form 943)

Source: www.realguestbloggers.com

Source: www.realguestbloggers.com

What Employers Need to Know about 941 Quarterly Tax Return?, Form 941 is due by the final day of the month after a quarter ends: If you’re an employer who pays wages and compensation that are subject to federal tax withholding or payroll taxes, then you may need to report wages and withheld taxes on irs form 941, employer’s quarterly federal tax return.

Source: nelliqhesther.pages.dev

Source: nelliqhesther.pages.dev

941 Mailing Instructions 2024 Maris Shandee, Insights into the form 941 for 2023 & 2024 tax years data required on form 941. About form 941, employer’s quarterly federal tax return.

Source: projectopenletter.com

Source: projectopenletter.com

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter, Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. That said, you'll need to wait for the latest updates from quickbooks for the latest and most accurate data for tax form filings.

Source: printableformsfree.com

Source: printableformsfree.com

Printable 941b Form Printable Forms Free Online, And indian tribal governmental entities; The internal revenue service (irs) has recently released the 2024 form 941, employer’s quarterly federal tax return, along with schedule b, report of tax liability for semiweekly schedule depositors, and schedule r, allocation schedule for aggregate form 941 filers.

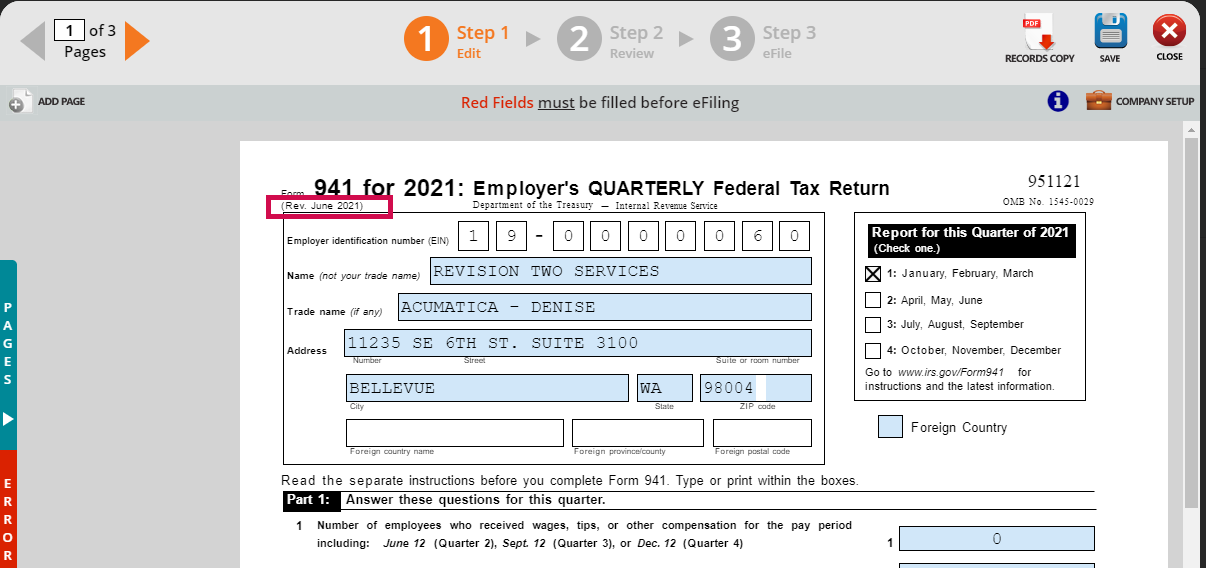

Source: community.acumatica.com

Source: community.acumatica.com

Updated Federal Government form available 941 for 2021 Employer's, The internal revenue service (irs) has recently released the 2024 form 941, employer’s quarterly federal tax return, along with schedule b, report of tax liability for semiweekly schedule depositors, and schedule r, allocation schedule for aggregate form 941 filers. Form 941 reports federal income and fica taxes each quarter.

Source: www.freshbooks.com

Source: www.freshbooks.com

What Is Form 941? Facts and Filing Tips for Small Businesses, The irs form 941, employer’s quarterly federal tax return, used by businesses to report information about taxes withheld such as federal income, fica taxes, and additional tax medicare tax withheld from the employee wages with the equivalent employer contribution. That said, you'll need to wait for the latest updates from quickbooks for the latest and most accurate data for tax form filings.

Source: goldiaqpersis.pages.dev

Source: goldiaqpersis.pages.dev

Form 941 Schedule B 2024 Amity Beverie, Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. And the instructions for the form, schedule b, and schedule r.

Source: dauneyalonda.pages.dev

Source: dauneyalonda.pages.dev

941 For 2024 Printable Sonni Cinnamon, About form 941, employer’s quarterly federal tax return. You can now file an amended form 940, employer’s annual federal unemployment (futa) tax return;

Source: shariawreba.pages.dev

Source: shariawreba.pages.dev

When Are Quarterly 941 Taxes Due 2024 Malva Rozalin, That said, you'll need to wait for the latest updates from quickbooks for the latest and most accurate data for tax form filings. Form 941 is due by the final day of the month after a quarter ends:

Insights Into The Form 941 For 2023 &Amp; 2024 Tax Years Data Required On Form 941.

Form 941 reports federal income and fica taxes each quarter.

Employers Must File Irs Form 941, Employer's Quarterly Federal Tax Return, To Report The Federal Income Taxes Withheld From Employees, And Employers' Part Of Social Security And Medicare (Fica) Taxes.

The irs form 941, commonly known as the employer’s quarterly federal tax return, plays a pivotal role for employers in reporting withheld taxes from employees’ wages.

Category: 2024